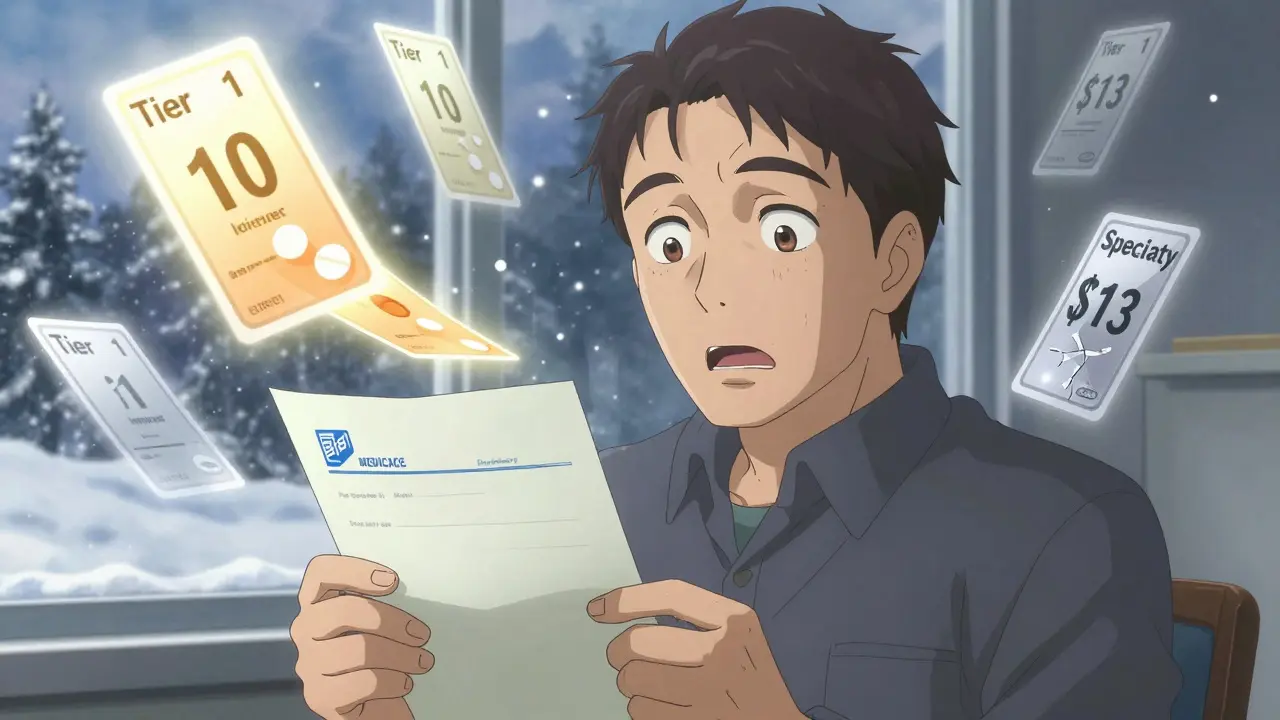

Every January, millions of Americans get a surprise in the mail - not a holiday card, but a letter from their Medicare Part D plan saying their favorite medication is no longer covered the same way. Some drugs are moved to a higher tier. Others are dropped completely. And suddenly, that $10 copay for your blood pressure pill becomes $113. This isn’t a glitch. It’s a formulary update.

Formularies are the lists your insurance company uses to decide which drugs they’ll pay for, and how much you’ll pay too. These lists change every year, and 2025 brought the biggest shift in over a decade. Thanks to the Inflation Reduction Act of 2022, Medicare Part D plans had to completely restructure how they cover medications. The goal? Lower costs for patients. The reality? A lot of confusion, and a lot of people switching to generics - whether they wanted to or not.

What Changed in 2025? The New Rules for Medicare Drug Coverage

Before 2025, Medicare Part D had a "donut hole" - a gap in coverage where you paid 100% of your drug costs after hitting a certain spending threshold. That gap is gone now. Starting January 1, 2025, once you hit $5,030 in out-of-pocket spending, you’re automatically in the catastrophic phase, where you pay only 5% of your drug costs or a small copay - whichever is higher.

But the biggest change? A hard cap on what you pay each year. For the first time, your total out-of-pocket drug spending is capped at $2,000. If you hit that limit, your plan covers 100% of your medications for the rest of the year. This alone will save an estimated 3.2 million Medicare beneficiaries an average of $1,500 in 2025. Some will save over $3,000.

These changes didn’t come with a free pass for brand-name drugs. In fact, insurers are now under pressure to cut costs wherever they can. That’s where generic switching comes in.

How Formularies Push You Toward Generics - And Why

Most Medicare drug plans use a tier system. In 2025, here’s what it looks like:

- Tier 1: Preferred generics - $1 to $10 copay

- Tier 2: Non-preferred generics and preferred brands - $47 average copay

- Tier 3: Non-preferred brands - $113 average copay

- Specialty tier - $113 or 25% coinsurance

Insurers make money by steering patients toward the cheapest options. That means generics on Tier 1. If your brand-name drug is on Tier 3, your plan will likely move you to a generic version - even if you’ve been on the brand for years.

It’s not just about savings. The Inflation Reduction Act also created the Medicare Drug Price Negotiation Program. Starting in 2026, Medicare will negotiate prices for 10 high-cost drugs - including Stelara, Prolia, and Xolair. To make those deals work, insurers must cover those drugs and their biosimilar alternatives. That’s forcing a wave of generic and biosimilar switches before the 2026 deadline.

For example, CVS Caremark dropped nine specialty drugs in 2024, but only six in 2025. Why? Because they replaced them with biosimilars like Kanjinti and Trazimera - cheaper versions of Herzuma and Ogivri. These aren’t just "similar" - they’re proven to work the same way, with fewer side effects and lower costs.

Generic Switching Isn’t Always Welcome - And It’s Not Always Safe

"I’ve been on Humalog insulin for 12 years," said one user on Reddit in October 2024. "My copay jumped from $35 to $113 overnight. My plan switched me to a different insulin I’ve never tried. I’m scared to use it."

This isn’t rare. AARP found that 68% of Medicare beneficiaries are worried about formulary changes affecting their meds. Diabetes and heart medications are the most common targets. When a plan moves a drug to a higher tier or removes it entirely, you’re not just paying more - you’re being forced to switch.

Doctors call this "non-medical switching" - changing your drug because of cost, not because your health needs it. And it’s up 23% since last year.

Some patients do fine. One user on HealthUnlocked switched from Humira to Amjevita - a biosimilar - and saved $450 a month with no difference in how she felt. But others aren’t so lucky. A 74-year-old man in Ohio had to stop his arthritis medication for two weeks after his plan switched him to a generic. His pain returned. His doctor had to file an exception. It took 12 days to get approved.

Not every generic works the same for every person. And some drugs - especially for chronic conditions like epilepsy, thyroid disease, or mental health - need to stay exactly the same. A small change in dosage or filler can throw off your entire system.

What to Do When Your Drug Gets Removed or Moved

You don’t have to accept a formulary change without a fight. Here’s what to do:

- Check your notice - Insurers must send you a letter at least 60 days before a change takes effect. If it’s a new generic, you might get only 30 days. Don’t ignore it.

- Call your pharmacist - They see formulary changes every day. Ask: "Is there a generic that’s covered? Will it work for me?" Pharmacists often know which alternatives are safe and affordable.

- Ask your doctor for an exception - If the generic isn’t right for you, your doctor can request a "tiering exception" or a "coverage exception." In 2024, 82% of tiering exceptions were approved. For drugs that were completely removed? Only 47% got approved - but it’s still worth trying.

- Request an expedited review - If you’re at risk of harm without your current drug (like if you’re on insulin or seizure meds), ask for a 24-hour emergency exception. You don’t need to wait 72 hours.

- Use your 30-day transitional supply - If your drug is being removed, your plan must give you a 30-day supply to help you switch safely. Don’t skip this.

Some plans, like Cigna and Aetna, also let you get a 30-day supply of your old drug while your exception is being reviewed. That’s a lifeline.

Who’s Making These Changes? The Big Three PBMs

Most of these decisions aren’t made by your insurance company directly. They’re made by Pharmacy Benefit Managers - or PBMs. These are the middlemen that negotiate drug prices and manage formularies for insurers. The three biggest ones:

- OptumRx (UnitedHealth) - 32% market share

- CVS Caremark - 28% market share

- Express Scripts - 24% market share

These companies decide which drugs get covered, which ones get kicked off, and which ones get moved to the lowest tier. And they’re getting more aggressive. In 2025, 78% of standalone Medicare drug plans (PDPs) pushed patients toward generics - compared to just 42% of Medicare Advantage plans (MAPDs). Why? Because PDPs have fewer ways to control costs, so they rely more on switching.

That means if you’re on a standalone Part D plan, you’re more likely to be switched than if you’re on a Medicare Advantage plan with drug coverage.

What’s Coming in 2026 - And How to Prepare

2025 was just the warm-up. In 2026, things get even more intense. The Medicare Drug Price Negotiation Program kicks in. Ten high-cost drugs will have their prices cut - and your plan will be required to cover them and their biosimilars.

That means:

- Stelara (ustekinumab) for psoriasis and Crohn’s

- Prolia (denosumab) for osteoporosis

- Xolair (omalizumab) for asthma

And their biosimilars? They’ll be everywhere. Experts predict biosimilar use will jump from 28% in 2024 to 45% by 2027. If you’re on one of these drugs, expect your plan to push you to the cheaper version - even if you’ve never tried it.

Start preparing now. Talk to your doctor. Ask: "If a biosimilar becomes available for my drug, will it work for me?" Write down your concerns. Keep a list of your medications, dosages, and why you need them. That list will help your doctor fight for you if your plan tries to switch you.

How to Stay in Control

Insurance changes are coming every year. But you’re not powerless. Here’s your checklist:

- Review your plan’s formulary every October - don’t wait for January.

- Call your pharmacy before December 1 to ask: "Is my drug still covered? What’s the copay?"

- Keep a printed list of all your meds and why you take them.

- If your drug is removed or moved, file an exception immediately - don’t wait.

- Use your 30-day transitional supply. It’s there for a reason.

- Don’t assume generics are bad. Many work just as well - and save you hundreds.

The system is changing. But if you know how it works, you can navigate it - and keep your health on track.

What happens if my insurance stops covering my brand-name drug?

Your plan must give you at least 60 days’ notice before removing a drug. You’ll get a 30-day transitional supply to help you switch safely. You can ask your doctor to file an exception to keep your current drug - especially if you’ve had side effects or poor results with generics. About 47% of these requests are approved, so it’s worth trying.

Are generics as safe and effective as brand-name drugs?

Yes - for most drugs. The FDA requires generics to have the same active ingredient, strength, dosage form, and route of administration as the brand. They must also be absorbed into the body at the same rate and extent. But for drugs with a narrow therapeutic index - like warfarin, levothyroxine, or some seizure meds - even small differences can matter. Talk to your doctor if you’re unsure.

What’s the difference between a generic and a biosimilar?

Generics are exact copies of small-molecule drugs, like aspirin or metformin. Biosimilars are highly similar versions of complex biologic drugs - like Humira or Enbrel. They’re not exact copies because biologics are made from living cells. But they’ve been proven to work the same way with no meaningful difference in safety or effectiveness. Biosimilars are usually 15-35% cheaper than the original.

Can I switch back to my original drug if the generic doesn’t work?

Yes. If you try a generic or biosimilar and it causes side effects or doesn’t control your condition, your doctor can request a coverage exception to get your original drug back. You’ll need documentation - like lab results or symptom logs - to support your case. The approval rate for these exceptions is higher if you’ve already tried the alternative and it failed.

How do I find out what drugs are covered by my plan?

Log in to your plan’s website and look for the "Formulary" or "Drug List" section. You can also call customer service and ask for your plan’s 2025 Drug List. Make sure you’re looking at the correct plan - if you have Medicare Advantage, your drug list may be different from a standalone Part D plan. Always check in October before open enrollment ends.

Will my insulin cost less in 2025?

Yes - for most people. The Inflation Reduction Act capped insulin costs at $35 per month for Medicare Part D enrollees. That applies to all types of insulin - including Humalog, Lantus, and NovoLog - no matter your tier. If you’re paying more than $35, contact your plan. You may be eligible for a refund or adjustment.

Kegan Powell

January 27, 2026 AT 09:27Paul Taylor

January 27, 2026 AT 20:30John O'Brien

January 29, 2026 AT 03:00Patrick Merrell

January 29, 2026 AT 04:42Marian Gilan

January 29, 2026 AT 12:19Desaundrea Morton-Pusey

January 29, 2026 AT 20:04Kathy McDaniel

January 31, 2026 AT 10:38Conor Flannelly

February 2, 2026 AT 01:18Conor Murphy

February 2, 2026 AT 17:52Kirstin Santiago

February 4, 2026 AT 14:24April Williams

February 6, 2026 AT 05:54Harry Henderson

February 6, 2026 AT 06:09suhail ahmed

February 8, 2026 AT 04:48Candice Hartley

February 8, 2026 AT 22:28astrid cook

February 10, 2026 AT 11:45