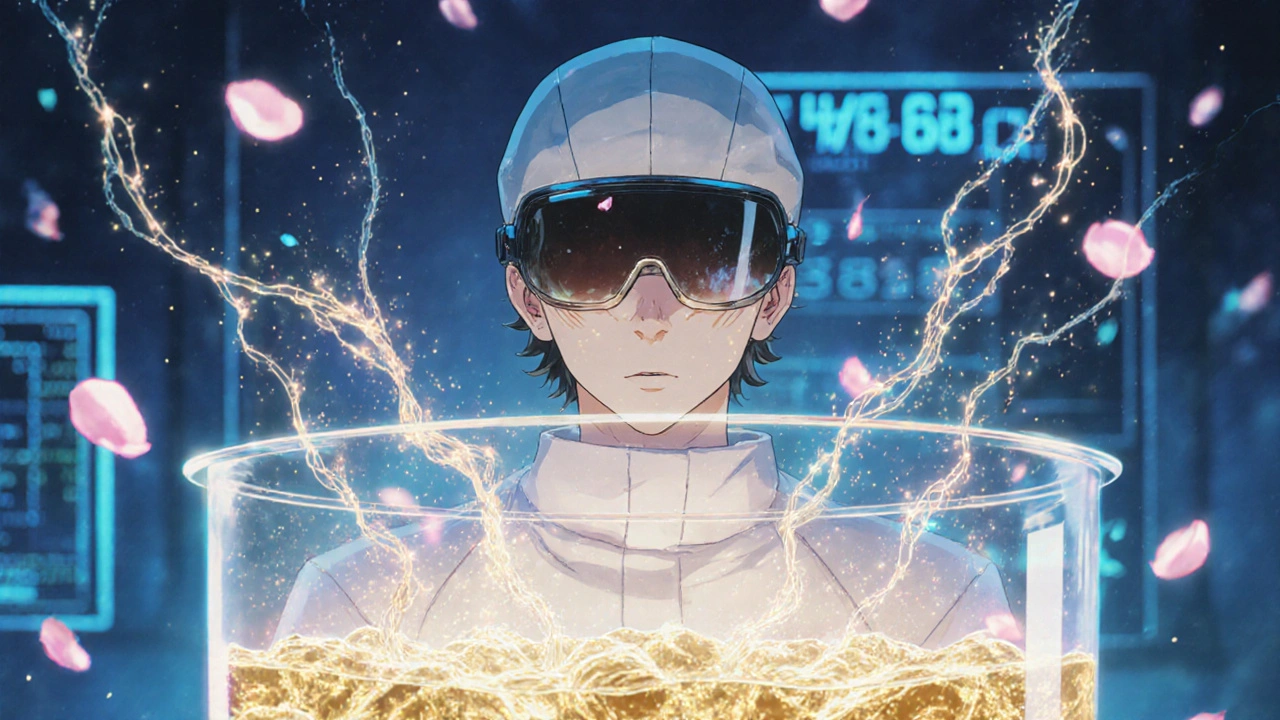

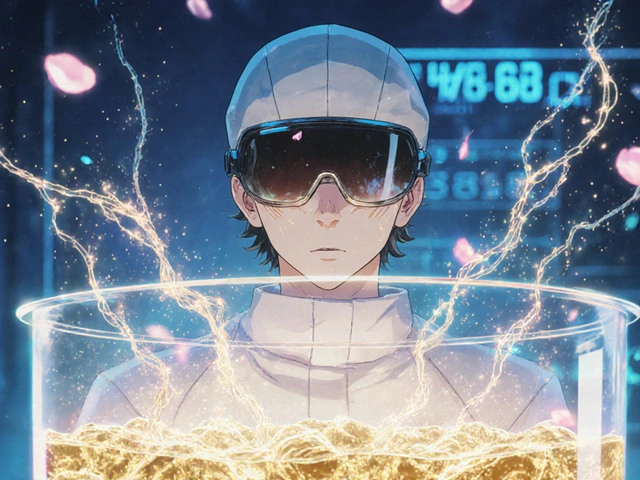

Biologic drugs aren’t pills you can just copy. Unlike your everyday cholesterol or blood pressure meds, these treatments are made from living cells-yeast, bacteria, or animal cells-grown in huge tanks under perfect conditions. One small change in temperature, nutrient mix, or pH can alter the final product. That’s why there’s no such thing as an exact copy of a biologic drug. Even the original manufacturer can’t make two batches that are 100% identical. And that’s not a flaw-it’s biology.

How biologics are made: It’s not chemistry, it’s farming

Small molecule drugs, like aspirin or metformin, are made in labs using chemical reactions. You mix ingredients, heat them, filter the result, and you get the same molecule every time. Simple. Repeatable.

Biologics? They’re grown. Scientists insert human genes into living cells-usually Chinese hamster ovary cells-and feed them sugar, amino acids, and oxygen in giant bioreactors. Over 10 to 14 days, these cells become tiny protein factories, producing complex molecules like antibodies. Then comes the hard part: separating the protein from everything else. It takes up to 10 purification steps, including protein A chromatography, viral filters, and ultrafiltration. One mistake, one contaminated tank, and the whole batch-worth half a million dollars-gets thrown out.

And this isn’t a one-month project. From engineering the cell line to shipping the final vial, it takes 3 to 6 months. Compare that to a generic pill, which can be made in days. The whole process is more like brewing beer under a microscope than manufacturing a chemical.

Why you can’t make an exact copy

The FDA says it plainly: biologics have "inherent variations" because they’re made by living systems. Even if you had the exact recipe, you couldn’t replicate the environment perfectly. The cells change over time. The bioreactor’s airflow shifts. The water quality differs slightly. These tiny differences affect how the protein folds, how it attaches to sugars, and how stable it is. And those changes? They matter.

Think of it like baking sourdough. Two bakers using the same starter, flour, and water can still end up with loaves that taste different. One might be tangier, another denser. That’s because yeast behaves differently depending on the air, the humidity, even the bowl it’s in. Now imagine that loaf is a medicine that treats cancer or rheumatoid arthritis. You can’t risk inconsistency.

That’s why generic versions of biologics don’t exist. Instead, we have biosimilars. These aren’t copies-they’re highly similar. They must match the original in structure, function, safety, and effectiveness. But proving that takes years. Biosimilars require thousands of lab tests, animal studies, and clinical trials involving hundreds of patients. The FDA doesn’t just accept "it looks the same." They demand proof that it works the same-and doesn’t cause unexpected side effects.

Biosimilars vs. generics: The real difference

Let’s clear up the confusion. A generic version of a drug like Lipitor contains the exact same active ingredient as the brand name. The molecule is identical. The FDA approves generics based on bioequivalence studies-showing the body absorbs it the same way.

Biosimilars? They’re not identical. They’re similar enough to be considered interchangeable, but they’re not clones. Take Humira (adalimumab), a top-selling biologic for autoimmune diseases. Its biosimilar, Amjevita, has minor structural differences in how its sugars are attached. But those differences? They don’t affect safety or effectiveness. That’s the goal: no clinically meaningful difference.

Here’s the catch: biosimilars cost less than the original biologic, but not as much as generics. A generic pill might cost $5. A biosimilar? Around $1,000 to $2,000 per dose, versus $5,000 for the original. That’s still a huge savings, but it’s not a 90% drop like with generics. Why? Because the manufacturing cost is still astronomical. You’re not just buying a chemical-you’re paying for a billion-dollar facility, 10,000 pages of documentation, and a team of scientists who’ve spent years perfecting every step.

The hidden cost of making biologics

Most people don’t realize how expensive biologics are to make-not just the price tag on the bottle, but the investment behind it. Building a single biologics manufacturing plant costs between $100 million and $500 million. A small facility might use 2,000-liter bioreactors. A large one? 15,000 liters. Scaling up isn’t just bigger tanks. It’s a complete re-engineering of the process. One Amgen engineer said it took 17 months and $22 million just to scale from 2,000L to 15,000L.

Quality control eats up 30 to 40% of the total cost. For a small molecule drug, it’s 5 to 10%. Why? Because you can’t just test for purity-you have to test for shape, charge, folding, glycosylation patterns, aggregation levels. You need 10 different instruments just to analyze one batch. And you have to do it for every single one.

Contamination is the biggest nightmare. A single bacterial speck in a bioreactor can ruin everything. That’s why cleanrooms are ISO Class 5-cleaner than a hospital operating room. Workers wear full-body suits. Air is filtered 500 times per hour. Even then, 35% of manufacturing failures are due to contamination, according to industry surveys.

Why biosimilars still struggle to take over

Even though biosimilars save money, they’re not replacing biologics as fast as you’d expect. Why? Three big reasons:

- Regulatory hurdles: Getting approval takes 7 to 10 years. You need to prove similarity across analytical, non-clinical, and clinical data. The FDA’s requirements alone span over 200 pages.

- Payer resistance: Insurance companies often don’t automatically switch patients to biosimilars. Doctors may stick with the original because they’re familiar with it.

- Manufacturing complexity: Only a handful of companies in the world can make biosimilars. It’s not a business for small players. The capital, expertise, and risk are too high.

Still, the market is growing. In 2023, global biosimilar sales hit $10.5 billion. By 2028, they’re projected to hit $30 billion. That’s a sign that change is coming-slowly, but surely.

The future: AI, continuous manufacturing, and cleaner production

Biologics manufacturing is changing. New tech is helping. Artificial intelligence now predicts how changes in temperature or nutrient flow will affect protein quality-before the batch even runs. Real-time monitoring tools track cell health minute by minute. Some companies are switching from batch processing to continuous manufacturing, where the product flows through the system nonstop, like a pipeline. That cuts production time by 20 to 30%.

Single-use bioreactors (disposable plastic bags instead of stainless steel tanks) are cutting contamination risk by 60%. But they’re more expensive and create more plastic waste. That’s a trade-off the industry is still figuring out.

And then there’s sustainability. Producing one dose of a biologic uses 10 to 15 times more water than a small molecule drug. That’s not sustainable long-term. Companies are now investing in water recycling, energy-efficient bioreactors, and renewable power for their facilities.

By 2030, most new biologics plants will be modular-small, flexible, and quick to reconfigure. That means faster responses to demand spikes, like during a new pandemic or when a new cancer drug hits the market.

What this means for patients

If you’re taking a biologic for rheumatoid arthritis, Crohn’s disease, or diabetes, you might eventually switch to a biosimilar. Your doctor will explain the options. You won’t get a generic version-because there isn’t one. But you might get a cheaper version that works just as well.

Don’t be fooled by claims that biosimilars are "inferior." They’re not. They’ve been tested more rigorously than most generics. The FDA requires them to be as safe and effective as the original. The only difference? They cost less.

And if you’re wondering why biologics cost so much? It’s not greed. It’s complexity. It’s science. It’s a billion-dollar factory running 24/7, with scientists watching every variable, because a tiny mistake could mean a patient doesn’t get the medicine they need.

Can a generic drug be made for a biologic like Humira?

No. Because biologics are made from living cells, they can’t be copied exactly like chemical drugs. Instead, highly similar versions called biosimilars are developed. These must prove they work the same way in the body through extensive testing, but they’re not identical at the molecular level.

Why are biosimilars cheaper than the original biologic?

Biosimilars are cheaper because they don’t need to repeat all the early-stage research and clinical trials the original drug went through. They rely on the original’s safety data and only need to prove they’re highly similar in structure and effect. Still, manufacturing costs remain high due to complex processes, so savings are typically 15% to 35%, not 80% like with generics.

Are biosimilars as safe as the original biologic?

Yes. The FDA requires biosimilars to undergo rigorous testing-analytical, animal, and clinical-to prove they have no clinically meaningful differences in safety, purity, or potency. Thousands of patients have used biosimilars without increased risk compared to the original biologic.

Why does biologics manufacturing take so long?

It takes 3 to 6 months because the process involves growing living cells in bioreactors over 10-14 days, followed by 10+ purification steps, extensive quality testing, and regulatory documentation. Each batch must be validated for consistency, and any deviation can lead to total loss. This is far more complex than synthesizing a chemical molecule, which can be done in days.

What percentage of biologics manufacturing fails?

Industry surveys show that 10% to 15% of biologics batches fail during production. The most common cause is contamination (35% of failures), followed by inconsistent cell growth or purification errors. Each failed batch can cost over $500,000, which is why manufacturers invest heavily in cleanrooms, automation, and real-time monitoring.

Edward Ward

November 15, 2025 AT 11:48It’s wild how we treat biology like it’s a factory assembly line when it’s clearly more like raising a child-every batch has its own personality, its own quirks, its own mood swings. You can’t just tweak a dial and expect the same result because the cells are alive, not inert chemicals. Even the same lab, same equipment, same protocol? You’ll get subtle differences in glycosylation, folding, aggregation. And those aren’t bugs-they’re features of life itself. The FDA gets it. They don’t demand perfection; they demand proof of consistency in outcome, not identity in structure. That’s why biosimilars aren’t copies-they’re cousins with the same DNA but different hairstyles.

It’s not about greed. It’s about entropy. Biology resists replication. Chemistry? Easy. Biology? It’s messy, beautiful, and infuriatingly unpredictable. That’s why we pay so much-not because some CEO is sipping champagne, but because a single bioreactor failure costs half a million dollars and three months of work. We’re paying for precision in chaos.

Jessica Chambers

November 16, 2025 AT 11:46So let me get this straight-we’re paying $5K for a drug because cells are *dramatic*? 😅

John Foster

November 16, 2025 AT 13:19There’s a deeper truth here that most people miss: we’ve spent the last century trying to reduce medicine to equations, formulas, pills you can swallow and forget. But biologics force us to confront the fact that life isn’t reducible. It’s not a machine. It’s a dance-between genes, proteins, sugars, and the invisible whisper of environmental variables. You can’t patent life, but you can patent the *process* of coaxing it into submission. That’s why the IP battles are so brutal. It’s not about the molecule-it’s about the ritual. The sterile rooms. The 10 purification steps. The engineers who stare at monitors for 72 hours straight hoping the cells don’t die. That’s the real product. Not the vial. The devotion.

And yes, biosimilars are cheaper-but not because the science got easier. It’s because someone else learned how to replicate the ritual without reinventing the wheel. But they still need to prove they can perform the same sacred ceremony. No shortcuts. No magic. Just patience, precision, and a whole lot of sterile suits.

We talk about drug prices like they’re a moral failing. But what if they’re just the cost of working with something that refuses to be controlled? Maybe the real scandal isn’t the price-it’s that we ever thought we could treat biology like a spreadsheet.

Ogonna Igbo

November 17, 2025 AT 18:13USA spends billions on these fancy drugs while people in Nigeria can't get basic antibiotics. You call this science? This is colonial medicine dressed in lab coats. Why not build factories here? Why not train our scientists? You make your billion-dollar machines and then act like we should be grateful for the crumbs. This isn't innovation. This is exploitation wrapped in jargon. Biologics? More like biocapitalism.

BABA SABKA

November 18, 2025 AT 08:56Let’s be real-this whole biosimilar thing is just Big Pharma’s way of extending monopolies under a new name. The original biologic companies spend $2B developing the drug, then spend another $1B suing anyone who tries to make a cheaper version. Meanwhile, the actual manufacturing cost? Maybe $50 per dose if you’re smart. The rest is marketing, litigation, and shareholder dividends. They call it ‘complexity’-I call it rent-seeking dressed up as bioengineering. Single-use bioreactors? More plastic waste. AI monitoring? Just to keep the profit margins fat. The real innovation isn’t in the science-it’s in the accounting department.

And don’t get me started on how they lobby to keep doctors from switching. It’s not about safety. It’s about inertia. And the FDA? They’re just the rubber stamp with a fancy logo.

Andrew Eppich

November 18, 2025 AT 23:05It is a matter of profound regret that the general public continues to conflate cost with greed. The manufacturing of biologic therapeutics requires an unprecedented level of scientific rigor, infrastructure investment, and operational discipline. To suggest that the pricing structure is arbitrary or exploitative is to demonstrate a fundamental misunderstanding of the biopharmaceutical enterprise. The regulatory burden alone-spanning over two hundred pages of documentation, thousands of analytical tests, and multi-year clinical validation-is sufficient to justify the price point. One must not confuse the complexity of biological systems with the inefficiency of market forces. The alternative-a world without biosimilars or biologics-is one in which millions suffer needlessly.

Chris Bryan

November 20, 2025 AT 19:59China’s got the labs. India’s got the generics. And we’re stuck paying for American-made biologics because our government won’t let us import the real stuff. This is why we need to stop outsourcing science and start bringing manufacturing back. We don’t need biosimilars-we need AMERICAN biologics made by AMERICAN workers in AMERICAN factories. This isn’t science. It’s a global scam where the U.S. gets billed for everything and everyone else gets the profit. Wake up.

Shyamal Spadoni

November 22, 2025 AT 17:00they say cells are alive but what if they are just programmed? what if big pharma is hiding the real recipe and the 'variations' are just a cover for them controlling the market? i read on a forum that the FDA is paid by the drug companies and the '10 purification steps' are just to make it look complicated so we keep paying. also why do they use chinese hamster cells? are they testing on aliens? i think the real reason biosimilars are expensive is because they dont want us to know how to make it ourselves. someone in china already cracked it but they are being silenced. also why is the water so important? water is just h2o right? or is it...?